Frequently Asked Questions (FAQs)

Our charges are fully transparent so that there are no surprises. Unlike banks or other money transfer operators, there are no hidden charges, no cable fees, no bank commissions, and no hefty foreign exchange mark-ups.

The safety of your money is as important to us, as it is to you. Your money is safe with us for 4 reasons:

Your funds are kept in a segregated client account.

As a regulated payment services provider, we must hold all money transferred by our clients in segregated bank accounts. These accounts are separate from our own bank accounts. So, your money is never mixed with ours, and we cannot use your money to settle any of our own obligations.We have a credible and trustworthy team.

The Shareholders and Directors of SingX are professionals who have worked with reputed multinational banks throughout their careers. They operate with the highest levels of integrity. Click here to read about the profiles of our key management.We work with Licensed Remittance Operators (LROs) in each country.

These LROs are licensed to do remittance transactions by the Central Bank in their respective countries. Click here Singapore: SingX Singapore Pte Ltd (licensed by Monetary Authority of Singapore, under RA No. 01513)

Hong Kong: SingX (HK) Co Ltd (licensed by the Customs & Excise Department, Hong Kong under license no. 16-09-01908)

Malaysia, Indonesia, Philippines & Thailand: Merchantrade Asia Sdn Bhd – (licensed by Bank Negara Malaysia, under license number APPW/1235/2015)

India: Federal Bank (operating as a fully licensed bank regulated by the Reserve Bank of India)

USA, Europe, Canada, Australia & UK: The Currency Cloud Group Limited (registered and authorised by the Financial Conduct Authority, under register number 900199. for more details on the licensed entities we deal with.We implement a host of security measures, just like the banks.

We take the safety of your personal details very seriously. To facilitate secure data transmission over the Internet, we have all the safety precautionsSystem integrity and the confidentiality of your personal and transaction details are our top priority. For data to be transmitted securely over the Internet, we use Secure Socket Layer (SSL), 128-bit encryption within the logged-in site pages. To check if your connection is secure, just look for the https url and the secure padlock symbol at the bottom right of your browser window or in the address bar.

All data is held on secure servers hosted by Data Electronics (ISO 9001:2008 and ISO 27001 certified) along with a managed firewall service as well as guaranteed power and connectivity to provide the highest levels of security 24/7. in place. We have adopted a two-step authentication process Two-factor authentication improves account security by combining what you know, e.g. your password, with something that only you possess, such as your mobile phone.

When trying to log in or carry out certain actions, such as transferring money, we will automatically send a One-time Password (OTP) to your phone. Enter the OTP into the two-factor authentication form on our site and you can transact with total peace of mind after that. which ensures complete security and peace of mind. We also ensure that our website keeps your connection secure Our website uses 256-bit encryption via Secure Socket Layer (SSL) from VeriSign. This means that your connection is secure.. All your account information is stored in a secure facility that is safeguarded by us.

Step 1: Check if we support your country of residence.

If you are a resident of Singapore, you can sign up with us. It's simple and free. Start now.Step 2: Complete your registration online.

The fastest way to register with SingX is to use Singpass. In case you don't have Singpass, you can register digitally by uploading a copy of your NRIC/FIN and taking a selfie! It just takes 5 minutes. Your account will approved within the same day!

Click to Register Now

For Business Accounts, please write to us at help.business@singx.co and we will take you through the sign-up process.

Before you start a transaction, make sure that you have completed the sign up process and received an email from us confirming that your account is ready.

-

Follow these simple steps to create your transaction:

On our Fair Exchange Calculator, select the From Currency, To Currency and enter the Send Amount

Click 'Start Your Transfer' to proceed.

Next, select your payment method:

Enter the receiver's details or select an existing receiver.

Review transaction details before clicking confirm and entering your SMS OTP.

If you have chosen the bank transfer option, you will need to login to your internet banking account and send the funds to our local bank account.

1. SingX Wallet - fund's will automatically be deducted from your wallet. In order to choose this option you need to make sure your wallet is topped up and has sufficient funds to fulfil the transaction. See - how to top up your wallet

2. Bank transfer - simply transfer the amount you are sending plus the SingX fee from your local bank account to our local bank account in Singapore using Internet Banking.

India:

- As an individual, there is no restriction on how much you can send.

- For business payments to India, there is an RBI limit of INR 1,500,000 per transaction. However, there is no limit on the number of transactions that businesses can place in a day.

Malaysia:

The maximum amount you can send to Malaysia is RM 150,000. However, please note that if your receiver is not a Malaysian national, banks may impose a lower transaction threshold (typically RM 10,000). As for remittances into bank accounts into Malaysia we may need supporting documents (eg. Invoices) for any payments above RM 50,000 and also for transactions where the receiver's bank may ask for clarifications from time to time, to fulfil their regulatory compliance requirements.

Indonesia:

The maximum amount you can send to Indonesia is IDR 999,999,999 per transaction. However, there is no limit on the number of transactions you place.

Philippines:

The maximum amount you can send to Philippines is PHP 500,000 per transaction. However, there is no limit on the number of transactions you place.

Thailand:

Thailand: For individuals, the maximum amount you can send to Thailand is THB 150,000 per transaction. For payments to businesses in Thailand, the maximum amount you can send to Thailand is THB 1,500,000 per transaction

United States of America:

For payments to individuals and businesses, the maximum amount you can send to USA is USD 75,000 per transaction.

United Kingdom:

For payments to individuals and businesses, the maximum amount you can send to UK is GBP 250,000 per transaction.

Canada, European countries, Australia: No limit

Here are 3 compelling reasons why you should use SingX for cross-border money transfers and international payments:

Enjoy great savings

You save up to 8% of the transaction amount every time you transfer money through us. Banks and other operators will usually charge you a hefty mark-up on the foreign exchange rate and have layers of hidden fees like cable charges and commission. SingX only charges a single small transparent fee.Enjoy speedy transfers

After we have received your money, it will take us between 1 and 3 working days to credit your nominated receiver's bank account, depending on the speed of Internet Banking transfers in the receiver's country. For more details on processing times, please click here.Enjoy the online convenience

Say goodbye to filling in complicated wire transfer forms, signing and delivering original documents to your bank branch only to learn that you have filled the form incorrectly. With us, it's way simpler. Your information is stored with us. You simply confirm that you are happy with the exchange rate and then transfer money to us online.

Currently, we offer transfers from Singapore, Australia and Hong Kong.

Step 1: Check if we support your country of residence.

If you are a resident of Singapore, you can sign up with us. It's simple and free. Start now.Step 2: Complete your registration online.

Our sign up is 100% digital and only takes a few minutes! We offer 3 easy options:- 1. Register via MyInfo - quick and easy registration through MyInfo login

- 2. Selfie-based Registration - requires uploading of your ID document (front and back) and taking a live selfie

- 3. Mobile-bill based Registration - requires uploading of your post-paid mobile bill and ID document (front and back)

- For businesses, please write to us at help@singx.co and we will take you through the sign-up process.

Once we have verified all your documents, you will receive a confirmation email from us. After this, you are on your way to enjoying a cheaper, faster, more convenient way of transferring money across borders with us.

- Singpass Login - if you have a valid Singpass account, you can do a quick sign up via this method. We'll only require a proof of address document if you are not a Singaporean or Singapore Permanent Resident.

-

E-Verification method -

- Photo Identification Document (ID)

- Mobile Bill - post paid bill showing your registered mobile number and address, not more than 3 months old.

-

Selfie method

- Photo Identification Document (ID)

- Your Selfie

- Proof of Address if you are not a Singaporean or Singapore Permanent Resident. This can be a utility bill, bank statement or credit card statement, which is less than 3 months old.

For business users, please write to us at help@singx.co and we will take you through the sign-up process.

MyInfo is a service which that allows SingPass users to manage their personal data and pre-fill forms in online transactions. This includes government-verified data that is retrieved across participating Government agencies and data that you contributed to form your profile. This means that users only need to provide personal data once to the Government, instead of providing data repeatedly for every online transaction

We constantly compare our fee to that of banks, remittance agents, card companies and others. These operators usually charge you a hefty mark-up on the foreign exchange rate and have layers of hidden fees like cable fees and commissions.

We save you money by using the mid-market rate. This is the wholesale rate at which the big banks transact with each other. While other retail players apply a 'mark-up' on this rate, we offer the wholesale mid-market rate. We charge a small transparent fee which is shown to you upfront.

Still not sure? Feel free to compare our rates with those offered by other providers.

Check out the Fair Exchange Calculator to find out the exact fee we charge and how much you save by transacting through us.

Besides, if you are converting from one Asian currency to another Asian currency, the bank will first convert the Asian currency to US Dollar and levy a foreign exchange mark-up. They will then convert the US Dollar into the other Asian currency you wish to convert to and levy a second foreign exchange mark-up.

So if you're comparing our transparent rate with that offered by your bank, make sure you add all these hidden charges.

To quantify your savings potential, please refer to our Fair Exchange Calculator.

If you are sending money from your DBS Bank account in Singapore, for example, follow these simple steps:

-

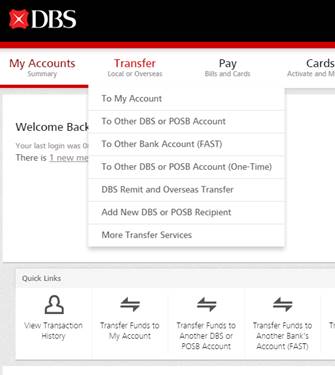

Step 1: Select 'To Other DBS or POSB Account' in the top menu after login.

-

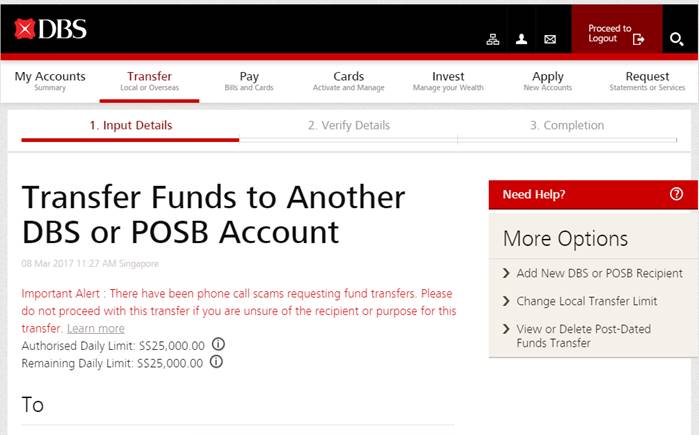

Step 2: After the authentication process, you will view the following screen. At this stage, you could click on 'Add New DBS or POSB Recipient' under 'More Options':

-

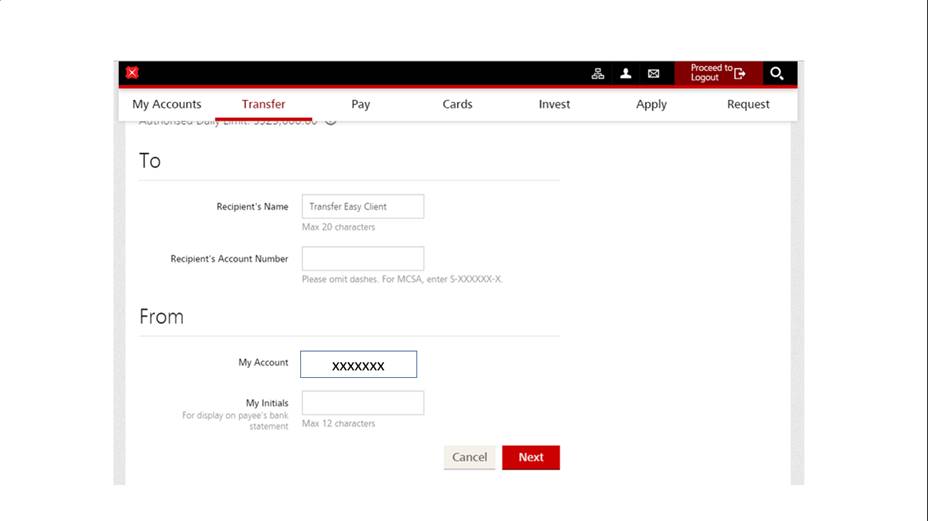

Step 3: This will take you to the screen below. Please enter the Recipient's Name as 'SingX Singapore Pte Ltd Client'. Even though the full name cannot be accommodated here, we will still receive your payment. Enter the account number as you see on your email with the subject 'Transfer Initiated'. Please enter your account name under 'My initials'. Then click Next. After the OTP verification, the account will get added as a recipient account. Then click on 'To Other DBS or POSB Account'.

-

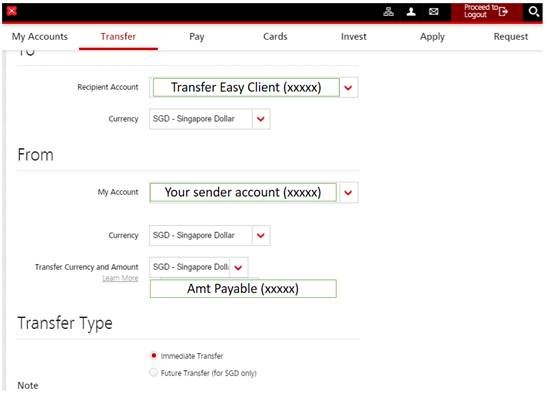

Step 4: Create the transfer instruction. There is no place available to enter a reference number in DBS' user interface. This is fine, we can still identify your transaction based on your name. If you have made more than one transaction, please email us via help@singx.co and let us know which transaction this is meant for.

We cannot take standing instructions for recurring transfers though. You will have to create a new transaction each time. Simply check the exchange rate, confirm the transaction, select your bank account and the receiver's bank account, and you are on your way. Once we receive your money, we will execute your repeat payment.

Instead, please invite them to sign up with us.

| No | Name | Website |

|---|---|---|

| 1 | BDO Cash Pickup | https://www.bdo.com.ph/branches-atms-locator |

| 2 | M Lhuillier | http://www.mlhuillier.com/branches/ |

| 3 | Cebuana Lhuillier | https://www.cebuanalhuillier.com/ |

| 4 | Palawan Pawnshop | http://www.palawanpawnshop.com/pera-padala |

| 5 | LBC Express | https://lbcexpress.com/ |

| 6 | BPI | https://secure1.bpiexpressonline.com/locator/search.aspx?loc=BRANCH |

| 7 | Metrobank | https://www.metrobank.com.ph/locate_branch.asp |

Your receiver needs to go in person to the pay-out partner's location. The receiver must carry a valid photo ID (Driver's license, passport, or any local government-issued photo ID, or a student ID). The receiver will also need to mention your (the sender's name), our service operators name (Tranglo), the transfer amount and a unique PIN that is sent to him via SMS. In the interest of safety, sometimes our pay-out partners may ask additional questions to establish the receiver's identity.Yes, your receiver can apply for a Foreign Inward Remittance Certificate (certificate of inward remittance) from his or her bank. Your beneficiary bank will contact our bank in India to confirm that the origin of the funds was indeed from outside of India.

Note that payments for the following purposes are only allowed through banking channels as per RBI guidelines:

Foreign Direct Investment (FDI)

Foreign Institutional Investment (FII)

This means we can't complete transfers for FDI/FII on your behalf, so a FIRC can't be issued.

However, in some cases, it may take 1 to 3 working days depending on the efficiency of internet banking at your receiver's bank. Please check the status of your transaction on the Dashboard. If for any reason, we were unable to credit the receiver's account, you can track your refund there too. For further help, please email us at help@singx.co.

Validity Period Guidance for all currencies (in Singapore time):

- Any transaction created between 12:00 am (midnight) and 5:00 pm will be valid until 5:00 pm the same day (including weekends and public holidays).

- Any transaction created between 5:00 pm and 11:59 pm will be valid until 5:00 pm the next day (including weekends and public holidays).

| Transaction Created On | Transaction Valid Until | Transaction Processed On** |

|---|---|---|

| Tuesday, 10am | Tuesday, 5pm | Tuesday |

| Tuesday, 6pm | Wednesday, 5pm | Wednesday |

| Friday, 7pm* | Saturday, 5pm | Monday |

| Saturday, 10am* | Saturday, 5pm | Monday |

|

* The Status on your dashboard will remain unchanged till Monday. ** The transaction will be processed subject to funds being received within transaction validity period. |

||

Most local banks offer instant transfers (via FAST), however please be aware that these are not always instant, so we request you not to wait till the last moment to transfer your money. To ensure that money is sighted by us in our bank account well before the cut off, please send your funds as early as possible.

If you wish to transfer money after the validity period has passed (i.e. the transaction has expired), then you will need to initiate a new transaction. Please note that our exchange rates are live and are constantly changing, so the exchange rate on your new transaction may differ from the rate on your old transaction.

SingX Wallet

SingX now offers a wallet which can be used for remittances, overseas bill payments and global mobile top ups.

To use this method, you will need to top up your wallet with funds first. There is a maximum limit of SGD5,000 that can be stored in your wallet at any given time.

Once your wallet has funds, you can create a transaction and indicate your wallet as the selected payment method. This will auto-deduct the funds from your wallet balance and process your transaction instantly!

Bank Transfer

After you create a remittance transaction, we will show you the payment instructions. They will include:

- A unique transaction reference number

- The amount you need to send

- Our bank account details

You can make this transfer via online banking. Simply go to your bank's website, log into your Internet Banking service and make the transfer. It is important that you enter the transaction reference number in the remarks or description field when sending the money through online banking.

- A unique transaction reference number

- The amount you need to send

- Our bank account details

After completing the transaction, you will also receive an email and SMS notification containing the unique transaction reference number.

- Login to your SingX account

- Click on 'Top Up' wallet

- Enter the top-up amount and select PayNow or Bank Transfer

- Login to your internet banking portal and send us the funds via PayNow or Bank Transfer

In addition, sending money using your wallet will enable us to process your transactions even faster!

Yes, the balance amount in your Wallet can be refunded upon request via help@singx.co However, there will be a small charge imposed for initiating a refund.

Paying bills is now a seamless and quick process online. You can make this payment instantly in a few simple steps:

- Login to SingX and Go to 'Bill Payments(India)' section

- Select your Billing Category and the respective operator from the dropdown

- Type in your consumer details and click on 'Proceed'

- Your bill details will appear on the screen

- Simply click to make the payment' via your SingX Wallet (auto-deduction)

At SingX, we offer customers a wallet which can be topped up using PayNow or Bank Transfer. You can pay your bills using this wallet – we'll auto-deduct the amount for you!

When you recharge DTH connection, the transaction gets completed within a few minutes and depending upon the processes of respecting operator, the recharged balance will reflect in your DTH account.

You can make online DTH recharge across various operators such as Airtel DTH, Dish TV Recharge, Tata Sky Recharge, Videocon D2H and Sun Direct Recharge.

The process of checking the DTH balance varies from operator to operator. The balance can be checked either online or on the operators' website or by contacting (SMS/ Call) the customer support number.

You can make online electricity bill payment via SingX across various operators such as UPPCL, TNEB, WBSEDCL, JVVNL, NBPDCL, PSPCL, SBPDCL, DHBVN, APDCL, BESCOM, UHBVN, APEPDCL, APSPDCL, CESC, UGVCL, DGVCL, CSEB, HESCOM, PGVCL, APEPDCL, BSES Rajdhani, BSES Yamuna and many more.

Broadband is high speed internet connection enabled through different mediums. Broadband bill payment can be easily done online in an instant. Online broadband bill payment ensures instant bill payment and uninterrupted internet services.

Payments are instant and easy. Once a user confirms the broadband bill payment, it is instantly reflected in their account. Processing by different broadband operators may vary.

SingX allows users to make the online broadband bill payment across a wide range of operators including ACT Fibernet, Airtel, ASIANET, BSNL, Comway, Connect, DEN, ION and many more.

Credit card allows users to avail short term credit from their banks for immediate payments. For credit card users it is very important to remember the credit card bill date. The user shall clear the dues monthly. If users don't make their Credit Card Payment on time, they are charged with interest. Further, untimely payment of the credit card bill also leads to late fee. In order to avoid unnecessary late fees and interest on credit card processing, users can instantly make their online credit card payment using SingX.

- American Express

- Andhra Bank

- Axis Bank

- Bank Of Baroda

- Canara Bank

- CITI Bank

- City Union Bank

- HDFC Bank Ltd

- ICICI Bank Ltd

- IDBI Ltd

- Indusland Bank Ltd

- Ratnakar Bank Ltd (RBL)

- Standard Chartered Bank Ltd

- State Bank Of India

- Syndicate Bank

- United Bank Of India

- Yes Bank

You can pay the minimum due amount. But if done on a regular basis, it can adversely affect your Credit Score.

Ideally you should pay your credit card bill in full but if you cannot do that, try to keep the balance as low as possible. Lower the balance, better for your credit score.

You should pay your credit card bill before the due date to avoid extra late fee charges.

Yes, late payments do affect your credit score. Whether you are thirty days late or three days late, a history of late repayment suggests that you are an unreliable borrower.

There are many companies which offer cable connection across the country like Hathway Cable, InCable, Reliance Digital TV, HiFi Vision, Digi Cable, etc. As the times change, even the cable operators have turned towards online payment modes instead of the conventional billing system. The conventional billing system required either the customers to visit the cable office to make the bill payments or the cable operator to come and collect the monthly bill. However, despite the facility to pay cable bill online, most cable TV subscribers still prefer to pay the cable bill through conventional means. The problem is that the payment portals to pay cable bill online are quite complex to navigate through. However, to solve this problem, SingX has integrated the payment portals of multiple cable operators within its portal. Now, you can easily and conveniently make the cable TV online payment using SingX.

You can send prepaid mobile credit to your friends and family. Simply select the country, enter the mobile phone number to top-up, choose the plan, enter your payment details and you're all set!

You can Top up mobiles in India, Malaysia, Philippines and Indonesia.

Top up is the Airtime, Data or bundle pack that you can load on a mobile phone number.

If you are an existing SingX remittance user,

- Login to your dashboard.

- Click Global Mobile Top ups.

- Select the Country.

- Enter the Mobile Number.

- Select the Operator.

- Select the Top Up Plan (Airtime, Data or Bundle).

- Review the order and complete payment using our secure online payment process.

- A confirmation message will appear on your screen with details on your completed transaction.

- A confirmation SMS will be sent to your mobile number.

NOTE: Recipients will also receive a transaction confirmation SMS message from their Mobile operator.

In order to access this service, you need to be a fully registered SingX customer.

You are receiving am OTP so that we can make sure this is your mobile phone number and prevent fraud.

Yes, each time you wish to top up, you will need to log in to your account. This is meant for security purposes. This will enable you to facilitate your transaction in case you stored or debit/credit card information.

Phone number needs to belong to one of the countries we serve and correspond to a prepaid account.

Don't worry, in this case the service will alert you and tell you we cannot send credit to this mobile phone.

Once you enter the mobile number you want to send credit to, you will be prompted to choose between different plans (Airtime, Data, Bundles). The plans depend on the mobile operator attached to the mobile number you're topping up.

You will receive an SMS. The recipient will also receive an SMS detailing the amount/plan credited to his/her mobile number.

In this case, first make sure you topped up to the correct mobile number. If you are sure, please contact our customer service at help@singx.co

The top up is sent right away to your recipient. Recipient will receive a confirmation SMS.

Unfortunately, the credit is sent right away to the mobile phone number you provided, and therefore a completed transaction may not be cancelled. This is why we show you several times during the top-up process the mobile number you're sending to, in order for you to double-check. Therefore, our policy in this case is to not reimburse the transaction.

You can pay using the SingX Wallet which can be topped up using PayNow or Bank Transfer.

You will receive a confirmation on the web interface, on your mobile. The recipient will also receive a confirmation on his mobile phone

Yes, you can send mobile Top Up to more than one mobile number.

The cost of a Top Up transaction is based upon the denomination amount selected. During the checkout process, the total amount payable will be indicated. This amount includes the details of any additional charges (such as taxes or SMS fees) that affect the ultimate Top Up recharge amount that will be received by the transaction recipient.

Please contact our support team immediately at help@singx.co

SingX utilizes the fairest exchange rate available, in keeping with international Foreign Exchange regulations and agreement with our partners. Exchange rates are subject to change and fluctuation on a daily basis.

If you forget your username/password or are unable to sign in, click on “Forgot password?” link on the login page. Our password policy is as follows:

- Minimum 8 alphanumeric characters password.

- At least one letter in uppercase.

- Must not repeat any letter or number.

- After you log into your account, you will find 'Manage Receivers' link on your dashboard.

- To add a new receiver: Click on the '+Add' button and enter all the relevant information for the bank account you wish to send money to, and click Save. To confirm the new account, a One-Time Password (OTP) authentication is required. You will receive an OTP on your registered mobile number. Enter the OTP exactly as received and click confirm. Once validated, you will see the confirmation/summary for the bank account you have entered. You can select the receiver's bank from the dropdown list.

- To delete an existing receiver bank account: select the respective receiver's bank account and click 'De-activate'. Click 'Confirm' and the selected receiver's bank record will be listed as inactive.

- After you log into your account, you will find 'Manage my bank accounts' link on your dashboard.

- To add new bank details: Click on '+ Add', and enter your new bank details. You can search for your bank by entering the bank name. Click 'Add sender' after all information has been completed. You will now see the new bank details listed on the 'My bank accounts' page.

- To delete an existing sender bank account: Click on 'Delete' against the respective bank account details. Click 'Confirm' and the selected bank account will be removed from the list.

- If you are sending money to India, you will also require the IFSC code and the receiver's address.

- If you are sending money to Malaysia, you will also require the receiver's nationality, address & contact number, receiver type (whether an individual or business), and if a business then business registration ID.

- If you are sending money to Hong Kong, you will require the Bank and Branch Code for your Receiver's bank account. These are three digit codes based on the Hong Kong Interbank Clearing System and if unsure, your Receiver can check for the bank clearing code and branch code here: http://www.hkicl.com.hk/clientbrowse.do?docID=7259

- Select 'Settings' from browser menu list.

- Select 'Show advanced settings...' at the bottom of the page.

- Under the heading 'Privacy', select 'Content Settings'.

- Under the heading 'Cookies', select 'Allow local data to be set' and make sure 'Block third-party cookies and site data' is unticked.

- Click 'Done' in the bottom right-hand corner of the popup window.

- Select 'Safari', next to the Apple logo.

- Select 'Preferences...', from the drop down menu.

- Select 'Privacy' in the popup window.

- In the category 'Cookies and website data', select 'Allow from websites I visit'.

- Select 'Preference' from browser menu list.

- Select 'Show advanced settings...' at bottom of the page.

- Under the heading 'Privacy', select 'Clear browsing data...'.

- At the top of the popup window, next to 'Obliterate the following items from:' select your desired duration to clear. (Recommended to be at least 'the last 4 weeks'.)

- Tick 'Cached images and files'.

- Click 'Clear browsing data'.

- Select 'Safari', next to the Apple logo.

- Select 'Preferences...', from drop-down menu.

- Select the furthest right tab 'Advanced' in popup window.

- At the bottom of the 'Advanced' window, you should see the option 'Show Develop menu in menu bar'. Tick this.

- Close popup window.

- Top of the screen, click on 'Develop' between 'Bookmarks' and 'Window'.

- In the drop-down menu, click on 'Empty Caches'.

- For Apple MacBook, press command + shift + 3 buttons and screenshot image will be saved on your desktop.

- For Windows, press Print Screen key and paste to image editor to save the screenshot.

- For iPhone or iPad, hold down home + lock buttons and screenshot will be saved into camera roll.

- For Android, please refer to the brand and model manual.

It is essential to make sure your Internet browser is up-to-date for best user experience and security. Using an outdated browser may pose data security threat.

We take the safety of your personal details very seriously. To facilitate secure data transmission over the Internet, we have all the safety precautionsSystem integrity and the confidentiality of your personal and transaction details are our top priority. For data to be transmitted securely over the Internet, we use Secure Socket Layer (SSL), 128-bit encryption within the logged-in site pages. To check if your connection is secure, just look for the https url and the secure padlock symbol at the bottom right of your browser window or in the address bar.

All data is held on secure servers hosted by Data Electronics (ISO 9001:2008 and ISO 27001 certified) along with a managed firewall service as well as guaranteed power and connectivity to provide the highest levels of security 24/7. in place. We have adopted a two-step authentication process Two-factor authentication improves account security by combining what you know, e.g. your password, with something that only you possess, such as your mobile phone.

When trying to log in or carry out certain actions, such as transferring money, we will automatically send a One-time Password (OTP) to your phone. Enter the OTP into the two-factor authentication form on our site and you can transact with total peace of mind after that. which ensures complete security and peace of mind. We also ensure that our website keeps your connection secure Our website uses 256-bit encryption via Secure Socket Layer (SSL) from VeriSign. This means that your connection is secure.. All your account information is stored in a secure facility that is safeguarded by us.

No, you do not need to register with SingX to subscribe for our rate alerts. However certain features are only available to registered users, hence for full access we recommend that you create an account. Registration is free and easy, click here to sign up now.

No, setting up rate alerts with SingX is free of charge for all users. We aim to keep you updated with our live exchange rates so that you can transact at the rates you want!.

- Rate reaches your desired value: Alert if the rate of the currency pair selected reaches your specified value

- Rate is at its Two-weeks high: Alert if the rate of the currency pair selected is the highest in the past two weeks

At this time, you can only set one rate alert for each currency pair. However, you can have both types of rate alert set up for the same currency pair. The two types of alert offered on SingX are: a) Rate reaches your desired value b) Rate is at its Two-weeks high. You may edit this rate alert by logging in to your SingX account and selecting Rate Alerts > Manage Alerts.

This option is available for all registered users of SingX. If you wish to receive the same type of rate alert via both Email and SMS, then please select "Both" option in the channel of communication.

Absolutely not. SingX provides 100% transparency with no hidden fees or foreign exchange markups. The rate alert that you receive is for the live, mid-market exchange rate.

Unfortunately, no. SingX provides live foreign exchange rates that are always fluctuating. Hence, we are unable to hold a specific rate indicated in the rate alert for customers. If you would like to enjoy the FX rate indicated in the rate alert, please log on to the SingX portal and book a transaction as soon as possible. After this, you will need to transfer the funds to SingX as indicated on the transaction page.

We will send you rate alerts five times if the rate crosses your set limit. For example, if you set a rate alert of 1 SGD to go above 46 INR, the rate alert notification will be sent 5 times (1 per day) when the rate goes above 46. After receiving the alert 5 times, you will then receive an email notification to set a new rate alert if you wish to continue receiving the alerts.

If the rate for your currency pair is the highest in the past two weeks, you will receive a rate alert. For example, if you set a two-week high rate alert for SGD to MYR, you will receive an alert if this condition is met. The two-week high rate alerts will be sent 5 times, after which you will receive an email notification to set a new rate alert if you wish to continue receiving the alerts.

- If you are a registered user with SingX: log in to your account, click on your profile, select Rate Alerts-> Manage Alerts. You can edit your existing alert by clicking on the edit icon shown at the end.

- If you are not a registered user with SingX, you are unable to edit your alert. However, you can delete the alert by using the unsubscribe link in the rate alert email and then create a new one.

You will receive one rate alert every 24 hours.

- If you are a registered user with SingX: log in to your account, click on your profile, select Rate Alerts-> Manage Alerts and simply delete the alerts you would like to unsubscribe from

- If you are not a registered user with SingX, simply click on the unsubscribe link in the SingX rate alert emails you have reeived.

Absolutely! Feel free to share this rate with your friends on social media or via email to help them enjoy unbeatable exchange rates with SingX.

No problem. Contact our helpful customer service team at +65 3158 4669 so they can guide you through the process of setting up rate alerts on our website. Alternatively, you may email us with your questions at help@singx.co